This website is dedicated to the existing clients of Tom Collins, a senior consultant at Medicare Simplified. Medicare Simplified is an independent organization that provides education to individuals who are evaluating their Medicare options. We do not sell any insurance products, we do not have any relationships with insurance companies, and we do not have any ties with Medicare.

Here you will find my online calendar to schedule conference calls. You will also find helpful information about many aspects and components of Medicare. I will also provide videos about complicated Medicare issues in the near future.

I conduct in-person seminars in Florida and hope to reach neighboring states soon. Scott Donahue, a senior consultant with Medicare Simplified, conducts seminars in Ohio, Kentucky, and Indiana. During the Covid19 pandemic we were unable to continue our in-person seminars. We started doing live online seminars. Though we no longer offer the live online seminars, we do provide a recorded seminar available online. If you have not attended one of our seminars in-person or online, I urge you to watch our online seminar. Click Here

Medicare Simplified provides education through our Educational Seminars and Personalized Service. We assist individuals who are turning age 65 (first eligible for Medicare) and those who are considering enrolling in Medicare after age 65 through one-on-one consulting. We also assist individuals already on Medicare with any changes they may want or need to make.

If you want to learn more about Medicare Simplified, click here to view the company's website. There you will find details about our service and testimonials from current clients.

Medicare Part A helps cover Medicare eligible inpatient care in hospitals, inpatient care in a skilled nursing facility, home health care services and hospice care services. In most cases, it makes sense to enroll in Medicare Part A once eligible unless you're covered by a High Deductible Health Plan arranged with a Health Savings Account (see HSA section below).

You can get premium-free Part A at 65 if:

Medicare Part B helps cover Medicare eligible physician services, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventative services. The standard base premium for Part B in 2024 is $174.70 per month. However it is "means tested" based on your modified adjusted gross income – you may have to pay more than $164.90/mo. (see Means Testing - IRMAA section).

If you are eligible for Medicare due to age (65 or older) and are covered by group health insurance based on active employment with an employer with 21 or more employees, you can defer Medicare Part B without late enrollment penalties later (Penalties explained in a separate section below). Your group remains primary to Medicare, Part B would pay after your group plan has paid. In most cases, if you are still working for an employer with 21 or more employees it does not make sense to enroll in Medicare Part B if you intend to remain on your group plan.

If you are eligible for Medicare due to age and there are 20 or fewer employees covered by your group plan, Medicare Part A&B will become primary to your group plan. If you do not enroll in Medicare A&B you will begin to accumulate late enrollment penalties (see Penalty section below). Your group plan will also pay secondary towards claims as if you had enrolled in Medicare... even if you did not enroll.

If you are under the age of 65 and eligible for Medicare due to disability the rules and requirements differ. If eligible for Medicare under 65 and covered by an employer sponsored group plan, the employer must employ 100 or more employees 50% of the year or more. If there are 100 or more employees, the group plan will remain primary. The beneficiary can defer Part B without late enrollment penalties later. However, if there are fewer than 100 employees 50% of the year, Medicare Part A&B will become your primary insurance and the group plan will become secondary. Many smaller employers will group together to obtain better group insurance rates. If your employer has a joined a group or association, only 1 of these employers must meet the 100+ (or 21+ if eligible due to age) employee requirement.

You can enroll in Medicare Part B during your Initial Enrollment Period, Open Enrollment or using a Special Enrollment Period (if you qualify).

Initial Enrollment Period

You are eligible for Medicare due to age the 1st of your 65th birth month unless you are born on the first of the month. For those born on the first, they are eligible on the first of the month prior to their 65th birth month.

Open Enrollment

January 1st - March 31st of each year. Enrolling in Part B during the Open Enrollment, Part B will begin the 1st of month following your enrollment. This enrollment period would only be used if you missed your Initial Enrollment Period and did not qualify for a Special Enrollment Period.

Special Enrollment Period

If you or a spouse is currently working, and you are covered by a group plan based on that active employment, you can sign up anytime you have the group coverage or within 8 months after the employment or coverage ends (whichever happens first). If you have COBRA or Severence health insurance, you must sign up during the 8 month period that begins the month after employment ends. COBRA will pay secondary to Medicare, if you are eligible for Medicare. COBRA will coordinate benefits as secondary, even if you do not enroll in Medicare.

If you are obtaining your health coverage through an employer plan at or after age 65, you should still review all the applicable Medicare rules to avoid potential penalties. You should also check with the employer Benefits or Human Resources Department as it pertains to the employer plan for those eligible for Medicare. Please do not assume the group coverage is better than Medicare - review all options.

Part B covers 2 types of services

Medicare Supplement plans also called Medigap, are sold by private insurance companies and pay for some or most of the costs ("gaps") left over by Medicare Part A or Part B. You must have both Medicare Part A and Part B to purchase this coverage. All plans are "standardized". This means all Plan A’s must adhere to the standard benefits to be offered in all Plan A policies (in other words, all Plan A’s cover the same things). This is also true for all the other Plans. Therefore, assuming the same Plan, some differences between insurance companies are the premiums, pricing methods and service.

Supplement Plans are standardized differently in Massachusetts, Minnesota and Wisconsin. These 3 states inacted Medicare reform at the state level before Medicare supplement plans were standardized in 2010 at the Federal level. If you live in one of these states, you should review your state’s material on Supplement Plans.

Some Supplement Plans have a Select option. This means you must use specific hospitals and, in some cases, specific doctors to get full coverage. Standard option Supplement Plans do not require you to use specific hospitals and/or doctors…you can use any that accept Medicare.

You can not add a Supplement Plan to an Advantage Plan. If you have a Supplement Plan (and do not terminate it) and purchase an Advantage Plan, the Supplement will not pay the deductibles, co-pays or coinsurance from the Advantage Plan.

How Medigap Plans are Priced

Medicare Supplement (Medigap) Plans can be priced or "rated" in the following three ways:

| Situation | If born before 1-2-55 or if your Medicare Part A started before 1-1-2020, you have the right to buy | If born on or after 1-2-55 or if your Medicare Part A started on or after 1-1-2020, you have the right to buy | When to apply |

|---|---|---|---|

| You are in a Medicare Advantage plan, and your plan is leaving Medicare or stops giving care in your area, or you move out of the plan's service area. | Medigap Plan A, B, C, F, K or L (You must also return to Original Medicare) | Medigap Plan A, B, D, G, K or L (You must also return to Original Medicare) | As early as 60 calendar days before the date your coverage will end, but no later than 63 calendar days after coverage ends. Medigap cannot begin until the Advantage plan ends. |

| You have Original Medicare and an employer sponsored group plan (includes retiree coverage or COBRA) or union coverage that pays after Medicare and that plan is ending. Some states offer additional rights in this situation. |

Medigap Plan A, B, C, F, K or L | Medigap Plan A, B, D, G, K or L | No later than 63 days after the latestest of these 3 dates |

| You have Original Medicare and a Medicare SELECT policy. You most of the Select policy's service area. You can keep your Medigap policy, or you may want to switch. |

Medigap Plan A, B, C, F, K or L | Medigap Plan A, B, D, G, K or L | As early as 60 days before coverage ends but no later than 63 days after coverage ends. |

| Trial Right. You joined an Advantage plan or All-inclusive Care for Elderly (PACE) when you first eligible for Medicare at age 65, and within the first year of joining, you decide you want to switch to Original Medicare. | Any Medigap plan sold in your state by any insurance company. | Any Medigap plan sold in your state by any insurance company (except Plan C or Plan F). | As early as 60 days before coverage will end but no later than 63 days after coverage ends. |

| Trial Right. You dropped a Medigap policy to join an Advantage plan (or switch to a Select Medigap policy) for the first time, you have been in the plan less than a year and you want to switch back. | The same policy you had before if the company still sells it. If your former policy is no longer available, you can buy Plan A, B, C, F, K or L. | The same policy you had before if the company still sells it. If your former policy is no longer available, you can buy Plan A, B, D, G, K or L. | As early as 60 days before coverage will end but no later than 63 days after coverage ends. |

| Your Medigap company goes bankrupt and you lose coverage through no fault of your own. | Medigap Plan A, B, C, F, K or L | Medigap Plan A, B, D, G, K or L | No later than 63 days from when coverage ends. |

| You leave an Advantage plan or drop a Medigap policy because the company hasn't followed the rules, or it misled you. | Medigap Plan A, B, C, F, K or L | Medigap Plan A, B, D, G, K or L | No later than 63 days from when coverage ends. |

NOTE: Current Medicare rules state if you have an Advantage plan for the first time in your life, you have one year to change your mind and switch to a Medicare Supplement plan. If you make the switch to a Supplement plan within the "one-year trial right", the Supplement plan is “guaranteed” - the issuing insurance company cannot turn you down nor can they impose any pre-existing condition exclusions.

However, if you attempt to switch to a Supplement plan after the one-year period, the issuing insurance company has the right to ask questions about your health and underwrite your application. This could result in limitations which could include the exclusion of pre-existing conditions or outright denial of coverage. Therefore, if you have an Advantage plan and you are beyond the one-year window (referred to as your “trial right”), you should assume you may be limited only to Advantage plans for the rest of your life, as going back to a Medicare Supplement plan could be impossible or the conditions may be unacceptable to you.

Advantage plans are offered by private insurance companies. To purchase you must be enrolled in Part A and Part B, live within the service area of the plan. You pay the $164.90 per month (or more) for Part B and the premium for the Advantage Plan (and the Part A premium if not free). Advantage Plan premiums can vary dramatically based on residency, coverage and company.

Types of Advantage Plans include Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-For-Service (PFFS), Medical Savings Account (MSA) and Special Needs Plans (SNP).

Health Maintenance Organization (HMO)

Medicare Part D Prescription Drug Plans (PDP) are available through private insurance companies. Medicare prescription coverage can be purchased as a stand-alone Part D plan or part of an Advantage plan (Part C). There are 20+ PDP available in each state. Plans will vary by:

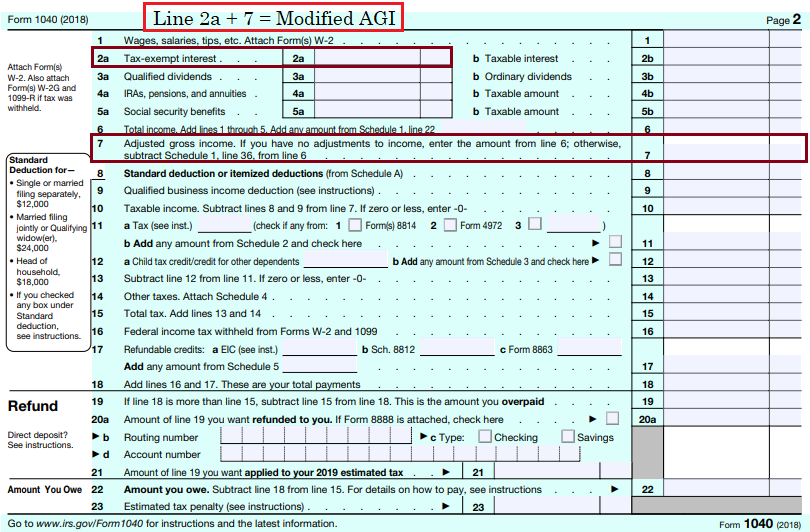

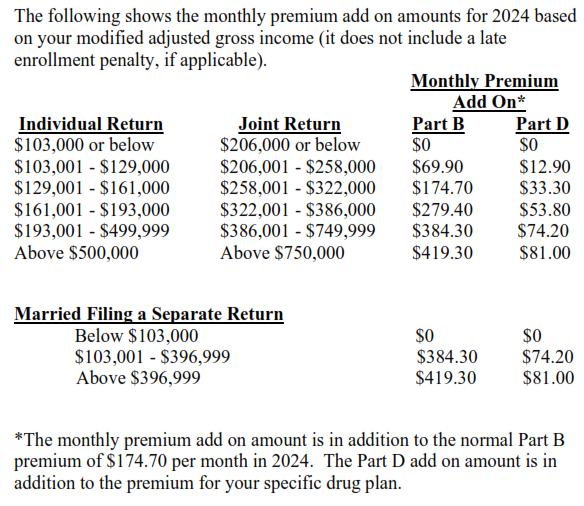

The premiums for Part B and Part D are means tested. This means the premium will increase if your modified adjusted gross income is over certain levels. Your modified adjusted gross income is your adjusted gross income plus tax exempt interest income. Your modified adjusted gross income from two years ago is used. If it has decreased since then, you may ask that a more recent year be used to determine your premium (certain criteria must be met).

Part A Hospital Insurance – The cost will increase 10% if you do not enroll within the first 12 months of being eligible. You pay this penalty for twice the time you could have had Part A, but did not sign up for it. You avoid this penalty if you qualify for the special enrollment period or if your Part A is free.

Vaccines - Beginning in 2023, all Medicare Part D plans and Advantage plans will be required to cover all ACIP-recommended adult vaccines with no cost sharing, even if the beneficiary is in the deductible phase of the benefit. For those 65 and older, ACIP-recommended adult vaccines are listed below. Vaccines in underlined italics recommended for those with additional risk factor(s) or another indication.

Expansion of Low Income Subsidy (LIS) - Beneficiaries with low income and limited resources are eligible for extra help paying their prescriptions. Those considered " deemed eligibles " do not need to apply and automatically qualify. Deemed eligibles are:

For those who must apply, they must meet certain criteria, of which one is income. The criteria as of 2023:

2023

INCOME

RESOURCES

Single

Less than $21,870

Less than $16,600

Married

Less than $29,580

Less than $33,240

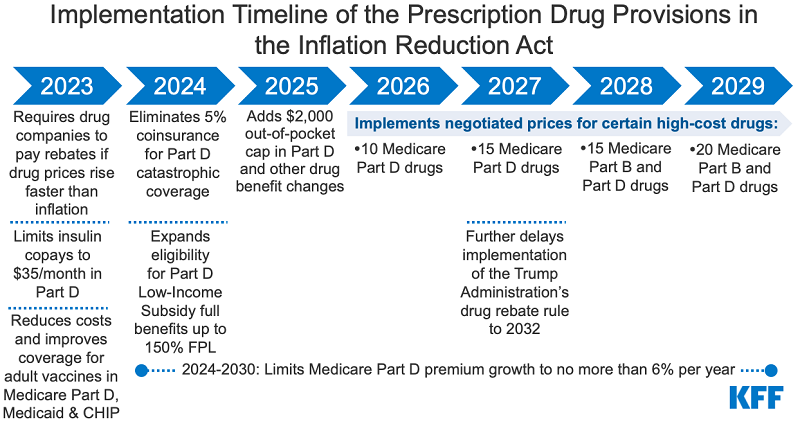

So what changes? Currently, you either qualify for full or partial help. Beginning in 2024 it will be all or nothing. To learn more about what counts as income and/or resources, click here: https://www.ssa.gov

Part D premium increase limit - Beginning in 2024 and until end of calendar year 2029, Part D plan premium increases will be limited to 6%. This limit was created so premium increases would not offset other savings included in the Inflation Reduction Act of 2022. Limits beyond 2029 have not been established but could be included in future legislation.

2025

The cap of $2,000 per year could increase over time if what Medicare spends on prescription drugs per enrollee increases.

Smoothed Cost Sharing - Beginning in 2025 it is required that Part D plans offer enrollees the option called smoothed cost-sharing. This means you can opt to have your out-of-pocket costs spread out over the year, helping those who enter the donut hole. This is designed to protect people from being hit with such a big drug bill at one time that it may discourage them from filling their prescriptions. Rather than paying reasonable copays in the Initial Coverage Level then later paying 25% the negotiated cost during the Donut Hole, they would pay level costs all year until reaching the $2,000 out of pocket maximum.

The official website of the United States government. The official Medicare website has useful information on what Medicare costs and covers. You can search for Advantage plans and Prescription drug plans. The Medicare website does not provide provider network data for insurance companies. You can search for hospitals, doctors, and medical equipment suppliers. Once you've created an account, you can also use the official Medicare website to see why a claim has been denied.

Q1medicare.com provides many tools and articles. The website is most useful when comparing how all Part D prescription drug plans or how all Medicare Advantage cover a particular expensive drug. Though the official Medicare website drug plan finder is better than Q1medicare.com when using a list of medications, Q1medicare.com provides more detailed information on each plan. Q1 not only shows the cost sharing for each tier but also the number of different drugs covered under each tier. This helps us compare overall value between plans.

GoodRx is a free mobile app and website that helps Americans save by finding them the lowest prescription prices in their neighborhood. There is also a paid Gold membership, which is generally not cost effective unless you are using multiple coupons every month. You cannot use GoodRx with Medicare prescription coverage but you can use GoodRx instead of Medicare. Certain lotions, creams, eyedrops and rescue inhalers are often cheaper with GoodRx rather than your Medicare prescription coverage. GoodRx is NOT insurance and should not be relied on as your only form of prescription coverage. GoodRx does not qualify as creditable prescription drug coverage as defined by Medicare.

Medicare does not cover any claims outside the United States. Most health insurance plans whether from an employer, union or the Federal Marketplace will not cover any claims outside the United States. For those traveling abraod, we strongly recommend a temporary travel health insurance plan. Squaremouth is an online company that compares travel insurance policies from every major provider in the United States. Squaremouth allows you to shop for policies à la carte, choosing how much and which kinds of coverage are important to you. Squaremouth has a strict “zero complaint” policy that allows consumers the peace of mind in knowing that they only deal with reputable insurance providers.